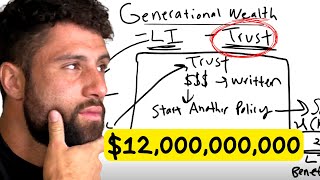

Keeping Life Insurance In A TRUST | GENERATIONAL WEALTH STRATEGY

Keeping Life Insurance In A TRUST | GENERATIONAL WEALTH STRATEGY

Explaining the step-by-step process of building generational wealth by placing an overfunded whole life insurance policy in a TRUST. #generationalwealth #wholelifeinsurance #lifeinsurancepolicy

Explaining the step-by-step process of building generational wealth by placing an overfunded whole life insurance policy in a TRUST. #generationalwealth #wholelifeinsurance #lifeinsurancepolicy

Get FREE Overfunded Whole Life Insurance Education and Resources – https://bttr.ly/yt-aa-vault

Ready to set up your own And Asset Policy? Schedule a free clarity call: https://bttr.ly/aa-yt-clarity

==================================================

Website: https://bttr.ly/andasset

Email: https://bttr.ly/info

======================

Financial Advice Disclaimer: All content on this channel is for education, discussion and illustrative purposes only and should not be construed as professional financial advice or recommendation. Should you need such advice, consult a licensed financial or tax advisor. No guarantee is given regarding the accuracy of information on this channel. Neither host or guests can be held responsible for any direct or incidental loss incurred by applying any of the information offered.

DISCLAIMER: https://bttr.ly/aapolicy

*This video is for entertainment purposes only and is not financial or legal advice.

Great job explaining this!! Will look forward to seeing more from you.

How about someone ripped off in a trust? By their own family members and ex boyfriend. But in turn the people that was ripped off was not who she believed to all her life??? They keep this from her for 63 year’s!! And they put a fraught death insurance policy on me !! You are exactly 💯 saying names and people that ripped me off UNBELIEVABLE!! 6:01

I feel like there is an elephant in the room. Example: I am 40, my daughter is 15. I implement this strategy: buy an insurance policy on myself and name the trust as a beneficiary. Let’s say I die when I’m 90. That would put my daughter at 65 years old. What happens when the death benefit pays into the trust, and the trust goes to buy life insurance on my 65 year old daughter, BUT she happens to be uninsurable to due to heath reasons?? And what if she doesn’t have children?

My whole goal is to never use a bank for anything but a credit card, checking account and a place for money to be flow through. I know of a couple of friends throughout my life that received trusts as inheritances, and they were set for life. 1 wasted it, and ruined her life, the other reinvested it in education, and built their life.

How soon can you use the money from the trust while living

also make it point to make sure ur heirs also study trust law contract n banking laws commerce laws ! public n private laws statutes codes common law n history of money!

Thank you so much for democratising the genius and secret of generational wealth

really good video thanks… But I have a question. You say that when you "died", your death benefit will be used to buy another Life Insurance for your kids… but if you die at 80, your kids may have 50 years olds or more!! isn’t too late to get the life insurance? also, at this age, a life insurance would be pretty expensive! Could you tell me what you think? Thanks for your help

Can you break this down further? One part of this doesn’t make sense to me. You say that they purchase life insurances as if they are guaranteed to provide a substantial ROI. This doesn’t make sense to me. Insurance companies are not in the business of loosing money. So how can it make sense to anyone that they buy life insurance as an investment to achieve significant ROI? I don’t think this is explained in the video and lacks clarity.

Sorry but you seem to present this as if we can all milk insurance companies by using this structure. Again. Doesn’t make sense. Insurance companies are smart and they want to make money on their customers, at least on average. Not give out money for free.

Thank you so much for this amazing video! I need some advice: My OKX wallet holds some USDT, and I have the seed phrase. (behave today finger ski upon boy assault summer exhaust beauty stereo over). What’s the best way to send them to Binance?

Cool video could you recommend a few big name trust companies that are seasoned and reliable? How much does this cost on average?

The trust should also own all the policies in addition to being the beneficiary.

Is this only american?

Excellent video. Once the money is in the trust can I turn it into a kind of bank for my family to use for educational purposes?

Great video mate – very interesting, please make more! I am watching from the UK at the moment and I would be interested to know if these stratgies are just as usable over here.

What about land and other physical and electronic properties? What about taxes?

What kind of trust. Revocable or non revocable?

As far as I’m aware there is only one group to make a smarter set up than the rocker fellers…..

The Catholic church, who use cest est vie trusts, genius tbh.

🫶

So it’s possible to receive money from 1 trust (parents, inheritance), and have it put in your own personal trust? I had that thought, but didn’t know if I was thinking right? I would imagine that it would turn into a self perpetuating cycle. That being the case, it would start to look like a subscriber base after awhile, but for money. I’ve read several books on this subject, and still learning, it’s actually turned into the topic of conversation within 2 of my friend bases. So when you get to a certain point, you need to take out more policies (I’m getting more excited), thus expanding the trust?? I’m looking to start a trust of my own, but I’m wondering if there’s a learning curve to living within a trust? I learned a ton watching those 2 girls (1 was a friend, but it hurt watching her do what she did), and didn’t want to repeat those mistakes. I also watched another friend, marry into a family with a trust (he thought he was going to have a say in how the money was spent (he had to sign a prenup and boy was he mad), and found out rather rudely, how wrong he was. There was a huge trust there, and he and wifey pooh went through it pretty good. Back in 2010 he told me the money was almost gone (he totaled a bunch of cars too.) but they thought they were set for life.

Hi guys I have 6 policies and I need help to set up a dynasty trust !!

You know you can currently pass over 13 million per person (26 million per couple) estate tax-free without buying some expensive whole-life policy and putting it in a trust. This is a legitimate strategy for the Rockefellers because their net worth was well beyond the estate tax-free transfer amount. For the rest of us, this is a stupid idea.

Nice bud

how can i withdraw my 89 USDT TRC20 from wallet to binance please help me 12 wallet recovery phrase: 《pride》-《pole》-《obtain》-《together》-《second》-《when》-《future》-《mask》-《review》-《nature》-《potato》-《bulb》

Thank you so much for explaining it so clearly and simply 🙌

I understand that when someone’s passes the money goes to the trust then it’s used to buy more policy’s in the name of the trustees. Rinse and repeat. Are they now borrowing against the policy’s to invest ? What type of insurance/ product did they buy? It won’t be term life for sure.

So what at what point and how do funds get distributed from the trust to future generations do they just it as a bank, or is there a point in time where they can take distributions from it if there are millions of dollars in there?

Ready to set up your own And Asset Policy? Schedule a free clarity call: https://bttr.ly/aa-yt-clarity

In india we need to pay GST on health insurance maybe 4% applicable 🤕🤒😷😴

but what if the descendents DONT work or make a business? What if young jimmy just takes a loan out on his policy, parties his whole life and then dies. The death benefit will "recharge" his portion completely? math work out that way?

Whoa

Friend in highschool got 3 mil at 19, within 1 year past out on pills In a pool dead.

What good is the money to anybody if it just buys more life insurance?

The tax-free savings from life insurance proceeds can be significant enough to be another income source. Wealthy people buy life insurance as a tax strategy. With the right estate planning, the tax savings can be huge and those savings build more wealth.

Very thoughtful video

Beautiful.

How does this method not get thinned out in money? If 1 person got the whole life insurance and dies, then the trust will somehow open 4 more for all your kids. Which can then open 16 policies? How does a single investment open potentially 100+ policies. Something here sounds too good to be true.

From what I understand about trusts, there is the revocable and irrevocable trusts. One you can modify but will pay taxes and can be pierced, and the other you can’t modify easily but won’t pay taxes on the estate. In the Rockefeller example or if someone were to do this today, which trust structure accounts for the generational part, benefitting people who aren’t born yet?

This is confusing!

Irrevocable trust?

What is Impact?

Rockefeller did not use IUL

Does this work in South Africa? I am a 19 year old currently working and I want to set myself up financially with the best options. Would WL insurance be a good thing to start?

Did the Rockefellers get rich by this process or are they using this as a loophole to the estate tax laws to preserve the wealth they already have?

Recommend keeping insurance and investments separate. And only get term policies until self insured.

Do it have to be whole LIfe or IUL can you used term life

So what happens if your policy expires and then there isnt any policy pay out? So what happens if you have paid in 100k on a policy but yet it simply expires, what happens then? Is that just the money that keeps the insurance agencies in business? What keeps them going and pays their paychecks if they are paying out more money through policies than what they bring in through premiums??

Too complicated⚠️ Got VERY bored trying to follow life insurances that nobody gets 🤣🤣🤣🤣🤣

ABSOLUTLY!! THAT ROTHSCHILD TRYPE ROYALTY WEALTH !!

wish my fam had done this !